Are discounted flower group buys a threat to flower shops?

[Hua11.com Original] Have you noticed that since the first half of 2019, various special-price flower group buys have suddenly flooded your social media Moments and communities? Interestingly, this trend aligns with the rise of internet community group purchases.

If you're reading this article, I assume you have some understanding of flower prices. Let's dive into a group of promotional offers for these discounted flowers (excerpted from Moments):

"

- Special-Price Flowers: Colorful Roses – ¥9.9 per bunch (18-20 stems)

- Special-Price Flowers: Forget-Me-Nots – ¥9.9 for an extra-large bunch

- Special-Price Flowers: Limonium – ¥5.9 for an extra-large bunch

- Special-Price Flowers: Nerine – ¥9.9 per bunch

- Special-Price Flowers: Solidago – ¥8.8 per bunch

- Special-Price Flowers: Hydrangeas – ¥6.8 each

- Special-Price Flowers: Stock – ¥4.99 per bunch

- Special-Price Flowers: Balloon Flower – ¥9.9 for an extra-large bunch

- Special-Price Flowers: Single-Headed Carnations – ¥9.9 per bunch

- Special-Price Flowers: Multi-Headed Carnations – ¥9.9 per bunch

"

Now, if you've ever purchased flowers or run a flower shop, what's your initial reaction upon seeing these prices?

"Crazy! Super cheap! It's insane!" And you might even collapse like this: ^_^

Indeed, these prices significantly undercut retail prices at flower shops, wholesale rates in traditional markets, and even some online flower wholesale apps. Some deals are merely a fraction of the usual cost. With such rock-bottom prices, they manage to attract a large number of price-sensitive buyers. "Two WeChat accounts with 10,000 followers each. Messages get missed all the time. My apologies, and thank you for your support!" This perfectly captures the reality faced by these special-price flower group buy merchants.

In this context, some Hua11.com students express concerns: Will these inexpensive flowers impact their own businesses? This concern is understandable. However, we believe there's little need to worry. In fact, this influence is minimal and, to some extent, even beneficial.

Why do we say so? Let's delve into the analysis:

I. Different Positioning

From a business perspective, florists provide a high-value service. With skillful hands, theoretical knowledge, and practical expertise, they transform individual flowers and foliage into works that meet customer needs, carry artistic and cultural significance, and convey specific meanings. This transcends mere material creation.

In contrast, special-price flower group buy merchants engage in the "trade" of flowers. They don't require extensive floral knowledge or even flower names. Their focus lies in product barcodes, purchase prices, and selling prices. For them, flowers are tradable commodities—a means to conduct business—disconnected from cultural connotations.

In their eyes, flowers are akin to any other product, much like pork.

To elaborate:

- Florists: They offer high-value, skill-intensive craftsmanship services, set prices for their creations, and earn substantial and reasonable profits.

- Group Buy Suppliers: Positioned in a category trade, they have limited value-added space. Unable to set prices, they can only secure meager resale profits (or even incur losses, as we'll discuss in the next point).

Different positioning attracts distinct customer groups and operates in separate competitive spheres. Each serves its purpose without posing significant threats.

Some students worry because they haven't fully considered their own positioning, mistakenly equating themselves with these suppliers. This is a positioning error. You possess craftsmanship, and Hua11.com's practical floral training model provides more opportunities than other florists (thanks to the one-year practice guarantee). Position yourself above other florists.

A slightly elevated position (mid-to-high end) yields dual benefits: increased profits and higher-value clientele.

Businesses positioned at the low end primarily attract price-sensitive individuals. These customers lack loyalty; they chase the lowest price. As the saying goes, "There's no loyalty that can't be bought for a penny." Moreover, meticulous bargain hunters can be challenging. Our experience with physical stores confirms this. Frequent dealings with such customers can be exhausting.

We strongly advise Hua11.com students against positioning in the mid-to-low end.

In summary, positioning matters greatly. Let's consider an analogy: A chef shouldn't compare themselves to a lady selling vegetables in the market. It's not derogatory; it's about recognizing distinct roles and incomparable positions.

You know what to do.

II. Special-Price Flower Group Buy Merchants Face an Inevitable Negative-Cycle Business Logic

In non-monopolistic industries without differentiated commodity trading, price becomes the primary competitive factor. Consider Taobao, where many purchases involve homogenous products with minimal quality variation. Most Taobao sellers sacrifice profits to attract customers, resulting in relatively lower quality. (For Taobao marketing channel analysis, refer to [Hua11.com · Marketing Advanced Series 1] Analysis of marketing channels for Taobao, Tmall, and JD.com (platform logic, customer quality, etc))

Similarly, the "commodity" of flowers exhibits similar attributes in the current industrial landscape:

- Non-Monopolistic Nature: Anyone can grow flowers (though variations exist due to climate and soil conditions).

- Uniformity within Grades: Even flowers grown in the same base are graded by quality.

- Low Supplier Branding: Suppliers lack strong branding.

- Limited Service Level and Added Value

So, what business logic do special-price flower group buy models—centered around flowers—encounter? Let's explore:

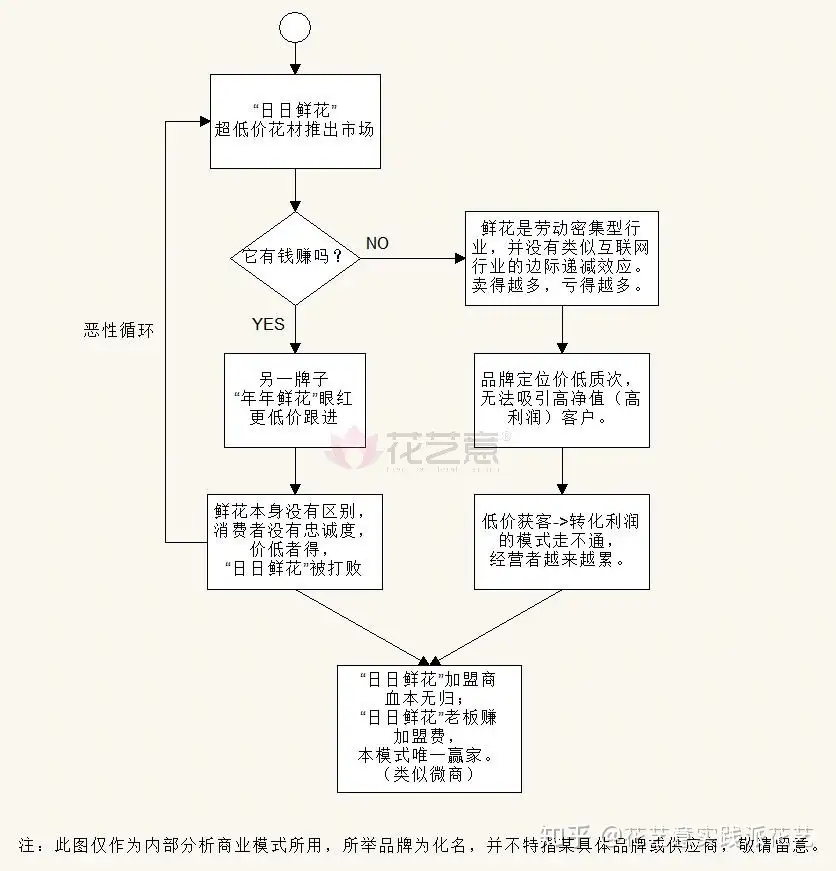

According to our analysis, regardless of whether this model is profitable, the sole winner is the creator who earns franchise fees. The rest merely accompany the game—a classic feature of traditional business models.

A crucial point in this logic warrants deeper explanation: Flowers belong to a labor-intensive industry, and the "marginal effect" remains relatively constant. (The "marginal effect" refers to the change in cost that suppliers incur for each additional unit of consumption by consumers.)

In other words, the more you sell, the more effort you expend. If selling one order results in a loss, scaling up exacerbates the losses. This contrasts with the operational logic of internet companies. The virtual nature of the internet significantly reduces the marginal effect. An internet company might lose on one order but profit from selling ten (often just opening accounts).

Therefore, operating this project in an internet-centric manner won't yield the same results.

III. The Essence of Special-Price Flower Group Buy Merchants and How It Benefits Us

In terms of the total output value proportion within the industry, flowers constitute a relatively small sector. Currently, the industry operates in a primitive manner. Consequently, many flower shop operators and florists wear multiple hats: site selection, decoration, store display, cleaning, maintenance, purchasing, transportation, material processing, packaging, product creation, photography, order communication, customer relations, after-sales service, promotion, and new product development—all handled by a single individual. Even gentle, soft-spoken florists find themselves transformed into resilient problem-solvers. The same challenges apply to male florists.

This industry state is atypical, marked by extensive but inconspicuous division of labor. Efficient, robust operation brands are lacking in each link. As flower enthusiasts, we believe in gradual improvement. Embracing change is essential. If a business form can assist us, shouldn't we welcome it?

The same holds true for special-price flower group buys. While this model itself isn't inherently profitable, its existence prompts us to consider how we can leverage it rather than suppress it. Upon reflection, we realize that these group buys serve as a conduit for flower wholesale channels. They proliferate in second, third, fourth, and fifth-tier cities, appearing in your local community and social media Moments. Their affordable prices facilitate your purchases, allowing you to focus on your craftsmanship while leaving inventory management to them. This clear division of labor benefits cost control.

Of course, it's expected (and confirmed by students) that the quality of these special-price flowers tends to be average, often falling within grade C or below. Categories can be unstable, and some practices may violate industry norms.

Consider this period chaotic—a time when we shouldn't actively participate. Instead, let's utilize these "tools" wisely and observe how things unfold.

IV. Potential Development Paths for Special-Price Flower Group Buy Merchants

Despite our internal analysis, certain logical challenges persist within this business model. Those who operate with real money likely possess deeper insights than we do. Understandably, no one aspires to engage in a low-end, labor-intensive business that yields minimal profits (or even losses). However, innovative thinkers remain adaptable.

Recently, some students in our group shared their observations: Special-price flower group buy merchants, beyond their original wholesale focus, have begun creating opening flower baskets, bouquets, and flower boxes. Consequently, some students perceive this expansion as a threat to their own businesses.

These concerns stem from an insufficient understanding of positioning. Customers drawn to special-price flowers are predominantly low-end consumers. A special-price brand won't attract mid-to-high end clientele. Even if they accumulate many customers, loyalty remains elusive. This holds especially true for cultural and artistic products like flower arrangements, which closely relate to personal identity. Your positioning determines the type of customers you attract.

Rather than fixating on these wholesalers, we should invest more effort in enhancing our craftsmanship and service quality. Achieving distinct, differentiated operations is crucial (see reference: [Hua11.com · Flower Shop Risk Defense Series 6] What to do in the floral industry's off-season? Find the best strategy to manage flower shop risks).

If we adopt an internet-centric perspective, their flexibility lies in attracting customers initially (offering low-priced flowers) and subsequently identifying profit points (such as wrapping flowers themselves). However, as mentioned earlier, their chances of success on this path are slim, and exhaustion looms.

Think broadly. It's reasonable for special-price flower group buy merchants to gain back-end benefits after investing heavily in customer acquisition. We mustn't be rigid. While others progress, we can't remain stagnant. Fortunately, ample opportunities exist within this industry. 😊 Unlike those bound by prior commitments, you're free and unencumbered—you haven't joined these brands or become ensnared in their model. Your agility and adaptability should surpass theirs.

With this analysis complete, the next steps involve easing anxiety, focusing on self-improvement, and taking action. You've got this!

Copyright Statement:

This article is an original creation by Hua11.com and is included in the “How to Run a Flower Shop and Floral Studio” Ebook. The content of this article may be periodically updated and is initially published on the Hua11.com official website blog. You can find the article at this link: https://hua11.com/blog/4692.html.

Reproduction of this article is permitted, provided that it is reprinted in full and all copyright information is retained. Any form of plagiarism, whether partial or complete, is strictly prohibited. Legal action will be taken against violators.

The work titled “How to Run a Flower Shop and Floral Studio” is copyrighted by Hua11.com. Additionally, the “Practical Floral Training” model and the concept of “Light Decoration” are original creations by Hua11.com. The trademark “花艺意” is registered and protected by relevant national laws.